Automation in Insurance Industry. Use Cases and Benefits

The mature insurance industry has withstood most of its macroeconomic challenges over the years. However, old-fashioned insurers are under constant pressure from savvy InsurTech firms: the latter are rapidly introducing new digital products to engage with customers. While modernizing just core systems has helped some old timers slightly bridge the gap, they recognize that true competitive advantage can only be harnessed by totally rebuilding outdated infrastructure.

Of course, it is not a one-day change. Within insurance, routine processes such as claims management, policy administration, accounting, and others continue to be repetitive and manual in their nature. These legacy processes require communication between multiple systems built on different technologies. Additionally, there are external systems that are beyond the control of most insurance companies. The reengineering and integration efforts required to digitize such tasks are still high, and this is where automation becomes important for insurers today.

In this article, we discuss how automation in insurance may help early adopters improve underwriting results, accelerate time to market for new products, and free up time for agents and advisors to focus on critical processes.

What is the Insurance Industry and why Automate it

Here, we still speak about a good old sector that offers financial protection against common risks like accidents, illness, or property damage in exchange for regular premium payments. It is crucial in reducing uncertainty and providing stability for individuals and businesses. There is no doubt that PEOPLE are at the core of this industry: it comprises millions of companies whose goals are focused on the well-being of their customers. However, dealing with an insurance company sometimes becomes a nightmare for its clients. Poor service, delays in responding to queries, and cumbersome procedures are some of the most common problems here. Plus, manual labor can cause many errors and confusion. This is why automation comes to the aid of insurance companies around the globe.

Benefits of Automating Insurance

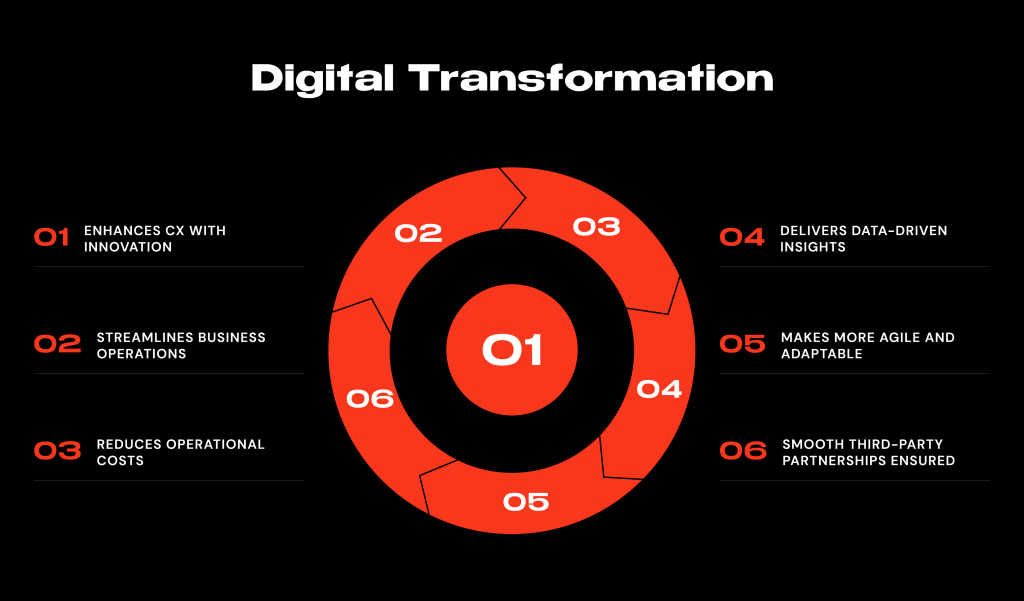

Many industry players are cautious when integrating technology into their processes. However, global digitalization is compelling them to reevaluate their strategies and objectives, directing their efforts toward maximizing client convenience. We understand that believing in success is crucial for initiating the first steps toward digital transformation as companies navigate truly uncharted territories. Therefore, it is crucial to show which amazing results they can achieve eventually:

Improved Operational Efficiency

Automation streamlines time-consuming and repetitive tasks like claims processing, underwriting, and policy administration. Companies can reduce manual errors, optimize workflows, and reallocate resources to more strategic functions.

Cost Reduction

RPA bots are a digital workforce that operates 24/7 without the need for breaks or salary increments. Thus, corporations can achieve significant cost savings by reducing operational expenses, minimizing the need for manual intervention, and improving resource utilization.

Increased Accuracy and Compliance

Automation technology ensures high levels of accuracy by eliminating human errors in rule-based tasks. It helps enhance regulatory compliance, reduces the risk of costly mistakes, and boosts overall operational transparency.

Technologies and practices for insurance automation

Robotic process automation in insurance is gaining momentum. Similar to other industries with numerous repetitive tasks, RPA assists organizations in achieving faster, more cost-effective, and error-free processes that liberate staff to engage in more valuable work. The technology can aid in addressing various challenges, such as:

Claims processing

RPA assists teams in data entry, document location, verification, and information distribution. When done manually, these tasks are time-consuming and divert workers from more intricate duties. RPA resolves this issue, enhancing productivity.

Underwriting

Underwriting and claims investigation are key processes that cut across all divisions of the company. RPA accelerates daily workflows by automating information collection, data entry, and customer analysis. The results? Employees make fewer mistakes, start working faster, and are able to process an average of 30% more applications per day. Clients are able to issue insurance policies remotely, and the number of unjustified insurance payments is reduced.

Policy management

After selling insurance policies, several administrative steps are necessary to maintain their validity. RPA aids in policy renewals by automating communications and issuing policy updates. Technology also automatically updates policies and customer data. Additionally, RPA is ideal for policy cancellations as it automates accounting and even refund processing.

Integration with legacy software

Like the banking and financial services industry, the insurance sector often relies on outdated software. Approximately 80% of insurance companies reported using software over a decade old! Upgrading these systems poses cost and business disruption concerns, prompting companies to stick with legacy software. However, RPA acts as a bridge between legacy systems and modern tools. It allows teams to interface current software with modern cloud solutions at a fraction of the cost of a complete IT overhaul.

Marketing

Insurance is a highly competitive niche, leading marketing teams to allocate substantial promotional budgets. According to this report, insurers typically allocate 11.2% of total revenue to their marketing budgets. Thus, RPA can also offer various benefits here, like automating email marketing and social media campaigns. When integrated with ML or data analytics tools, RPA can also help teams extract campaign data.

AI/ML and data analytics

Modern underwriting leverages ML for predictive analytics, fraud detection, and personalized pricing. RPA tools play a vital role in this process by gathering and cleaning data from various sources, ensuring data reliability and increased accuracy.

AI has made it possible to qualitatively improve and increase the efficiency of interaction between market participants – insurers, their partners, and clients – by automating many complex processes. For example, digital settlement of an insurance event with the recognition of car damage from a photo is made possible by using the ComputerVision technology.

Artificial intelligence is actively used in pricing, assessing demand, optimizing operational processes, interacting with clients, and working with personnel. However, there are areas where AI has yet to demonstrate its potential – for example, in the development of new products for the prevention of insurance claims, especially in medicine and auto insurance.

Blockchain-based secure operations

No, we are not talking about cryptocurrencies. Cryptocurrencies are one of the implementations of blockchain technology. In a nutshell, blockchain is a distributed ledger technology whose records cannot be falsified, making data exchange or transactions secure and transparent. In insurance, blockchain is seen as a technology that helps streamline the claims process and minimize insurance fraud. From the client’s point of view, the convenience of blockchain is that the client will no longer need to collect and store the original documents necessary for payment. Ideally, blockchain makes it possible to achieve a so-called “seamless” customer experience – when only a few minutes will pass from the moment an insured event occurs to the moment the insurance payment is received.

Augmented Reality (AR)

AR technologies can be used both to introduce clients to the insurer’s products and for entertainment purposes (for example, to give clients a virtual tour of the insurance company’s office and get to know its employees).

Big Data

General digitalization generates large volumes of various data, which is today called Big Data. By itself, this data may not mean anything, but with proper analysis of data from various sources, it can carry valuable information not only for the insurer but also for the client. What does it mean? For instance, a man named Alex ordered alpine skis from an online store. The next day he booked a hotel in Courchevel and a flight to France. With a high degree of probability, Alex is going skiing. Having received this data, the insurer will be able to offer him to purchase a policy that covers sports injuries. If Alex had such a policy, then the insurer would simply remind him that his insurance covers winter sports and that the client could ride in peace. This is a fairly simple Big Data use case. By analyzing big data from various sources, such as social networks, wearable devices, and online stores, insurers can gain a more complete understanding of their clients’ risks and warn them in advance about possible dangers, thereby helping to avoid possible insurance events.

Let us give you just a few inspiring examples:

Cattolica Assicurazioni, an Italian insurance firm, utilized UiPath’s RPA to automate their financial reconciliation processes. By deploying RPA bots to handle tasks like matching 20,000 lines of numbers, they completed a project that would have taken six months in just two months with zero errors, thanks to 90% automation achieved.

SCM Insurance Services in Canada achieved an 80% faster claims completion rate by fully automating data entry for FNOL. Additionally, EXL, a major US property and casualty insurer, reduced worker compensation claim handling time by 60% within just four months of implementing RPA in insurance.

ERGO, a German insurer, faced challenges in complying with Germany’s law requiring the transfer of active contracts between insurance brokers. By adopting Blue Prism’s RPA, ERGO automated the process, saving over 2,000 hours of manual labor previously required to fulfill these requests.

Development of a Solution for Insurance Automation

Before creating a solution that will help your company automate repetitive tasks, you must go through several stages. First, conduct a comprehensive assessment to identify processes that have to be automated. Determine business goals: for example, if your goal is to improve customer service, you should automate claims management. Then, it is time to find a reputable development company with expertise in the sector. The goal here is to find specialists who understand the intricacies of this industry. For instance, Ein-des-ein excels in developing platforms that handle claims processing and underwriting.

What else do we recommend to keep in mind?

- Prioritize security measures to protect sensitive data.

- Consider scalability and flexibility in the solution architecture.

- Foster a culture of continuous improvement to ensure your solution evolves in line with current business needs.

- Find a reputable development partner with the right expertise that shares your values!

FAQ

-

How insurance agents can use marketing automation?

- Agents can communicate with potential customers through personalized emails and messages. By automating routine tasks like sending follow-ups, they may actually spend more time building relationships and closing deals. Moreover, these tools help agents track how interested people are, learn from the data they collect, and improve how they market their services.

-

What automation software do insurance companies use?

-

Firms often utilize insurance process automation tools such as:

- CRM systems for managing customer data

- marketing automation platforms for lead generation and nurturing

- claims processing software for automating claims handling procedures.

-

What is insurance document automation?

- IDA refers to the process of using technology to create, manage, and distribute documents within the industry automatically. This includes generating policies, certificates, and other paperwork through automated systems. IDA greatly boosts the success level of automation in insurance industry. By automating document-related tasks, companies here greatly reduce manual errors and improve compliance.

-

What types of products does your company create? Provide a relevant case from your portfolio.

-

Ein-des-ein creates various products for the industry. For instance, recently, we embarked on creating a custom marketing automation platform. Initially, we designed a user-friendly dashboard. It allowed the client to monitor leads, campaigns, and performance metrics. We then integrated a lead capture feature. It enabled the seamless collection of prospect information through customizable forms on the client’s website. Additionally, we implemented automated email campaigns. Here, personalized emails were sent based on lead behavior and engagement levels, enhancing lead nurturing. Furthermore, we incorporated a lead scoring mechanism. It assigned scores to leads based on their interactions, helping prioritize high-quality prospects. Another key feature was the CRM integration. It enabled seamless synchronization of lead data with the client’s CRM platform for holistic lead management.

We also included a dynamic content personalization feature, tailoring website content and emails based on individual lead preferences and behavior. Moreover, we developed automated follow-up workflows. They triggered specific actions based on lead responses, ensuring timely and relevant communication. A/B testing functionality helped optimize campaign performance by testing different elements and analyzing results for continuous improvement.

We also added a segmentation feature to categorize leads into specific groups for targeted marketing efforts. We also implemented a lead qualification process. It automatically determined lead readiness for sales handoff based on predefined criteria. Lastly, we included a workflow automation tool that allowed the client to create customized workflows for various marketing activities.

We also have experience in other industries when it comes to automation tools.

For instance, we also worked on a custom RPA solution for a logistics corporation. Initially, we conducted in-depth consultations with the client to understand their challenges. We analyzed the existing processes and identified repetitive tasks suitable for automation.

Additionally, we integrated the solution with the client’s existing systems, such as ERP and warehouse management software, to ensure seamless data exchange and process synchronization. The RPA solution included features like data extraction from shipping documents, automatic invoice generation, and real-time monitoring of logistics operations.