Startup, VC & Tech Digest — September 2025

We know you don’t have time to read every article out there, so here’s a short digest of the recent startup, venture, and tech news from September. Just the essentials — big deals, fresh launches, and shifts you’ll want to know about.

CoreWeave expands OpenAI deal to $6.5B

The AI cloud provider extended its partnership with OpenAI, bringing their total deal value to $22.4B. CoreWeave will continue supplying critical infrastructure for OpenAI’s large-scale models.

Modular raises $250M to rival Nvidia

AI infrastructure startup Modular secured $250M to accelerate its development of tools competing with Nvidia. This reflects growing investor interest in alternatives to Nvidia’s ecosystem.

Nothing raises $200M at $1.3B valuation

Consumer tech brand Nothing closed a $200M round, raising its valuation to $1.3B. Funds will support hardware innovation beyond smartphones.

Colossal Biosciences secures $120M at $10.3B valuation

Colossal Biosciences, famous for de-extinction projects, raised $120M to focus on reviving the dodo bird and advancing genetic engineering.

Emergent raises $23M for no-code app builder

Emergent secured $23M to expand its no-code platform that lets users build apps from simple prompts, aiming to democratize app development.

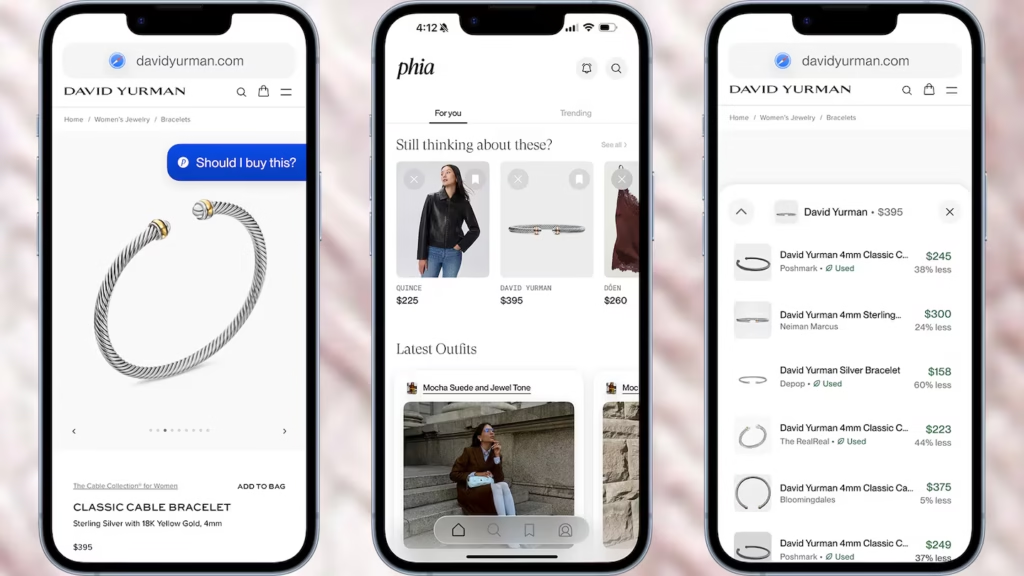

Phia raises $8M for Gen Z shopping app

Phoebe Gates and Sophia Kianni raised $8M for Phia, a sustainable shopping app targeting Gen Z. The platform merges e-commerce with climate-conscious engagement.

Cohere valued at $7B, partners with AMD

Cohere reached a $7B valuation and partnered with AMD to enhance NLP capabilities. This strengthens its position in enterprise AI.

Signal AI raises $165M with Nvidia backing

Signal AI secured $165M from Nvidia and other investors. The UK startup focuses on AI-driven enterprise insights, aiming for global leadership in decision intelligence.

Corintis raises $24M for chip cooling

Corintis raised $24M to advance its liquid cooling systems, adding Intel chairman Lip-Bu Tan to its board to address data center heat challenges.

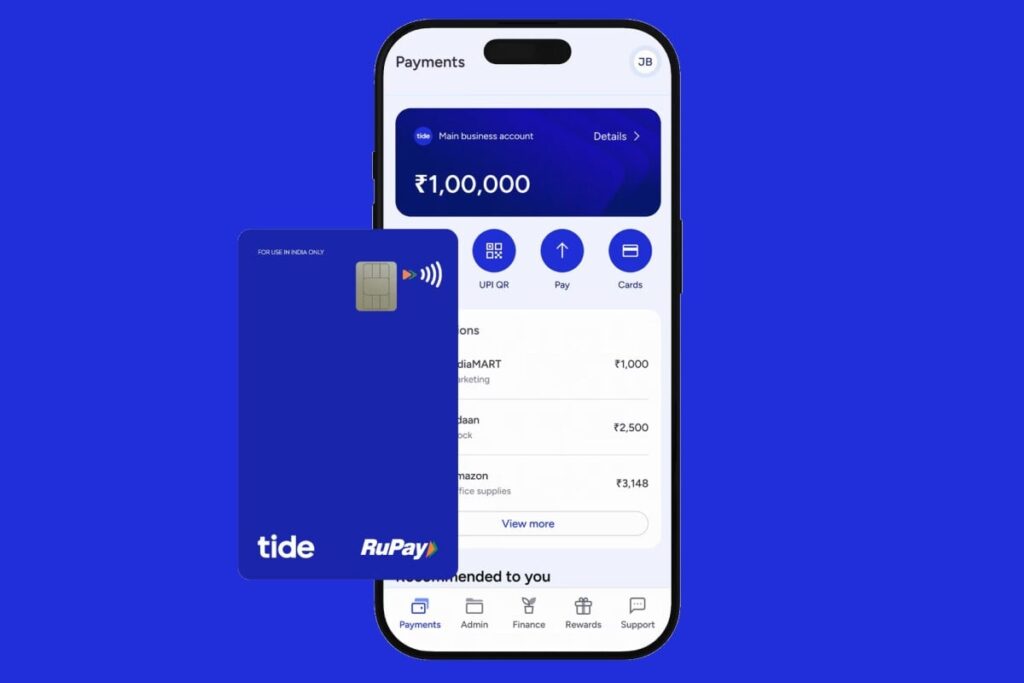

Tide secures $120M at $1.5B valuation

UK fintech Tide raised $120M led by TPG, increasing its valuation to $1.5B. Funds will expand SME banking across Europe.

Unicorn Board hits $6T valuation

Crunchbase reports global unicorn valuations hitting a record $6T despite slower creation rates, with AI and fintech dominating.

Revolut pledges £3B investment in the UK

Revolut committed £3B to expand UK operations in pursuit of a full banking license, signaling a major step in becoming a regulated bank.

Oracle in $20B AI cloud talks with Meta

Oracle is in talks with Meta for a $20B+ multi-year deal to provide AI cloud infrastructure, potentially one of the largest AI compute contracts.

Supercal challenges Calendly

Paul English launched Supercal, a new scheduling platform competing with Calendly, aiming to simplify coordination with AI features.

Big Tech doubles down on AI infrastructure

Meta, Oracle, Microsoft, Google, and OpenAI announced major infrastructure deals, reflecting growing compute demand as AI adoption surges.

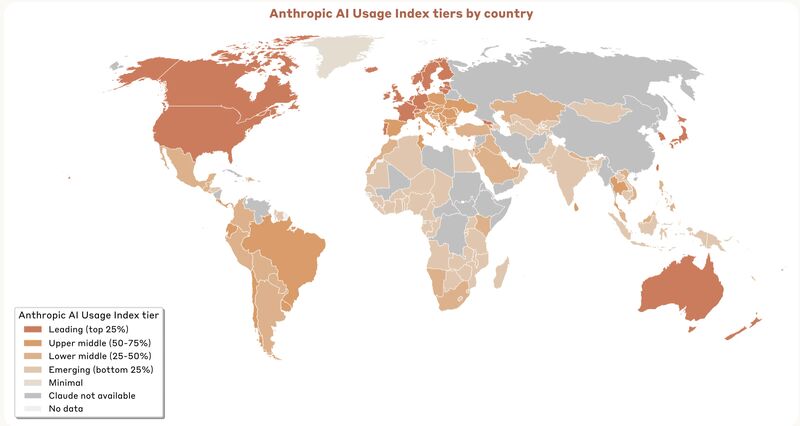

Anthropic’s Economic Index shows uneven AI adoption

Anthropic’s Economic Index reveals significant regional and industry variation in AI adoption, with developed economies leading.

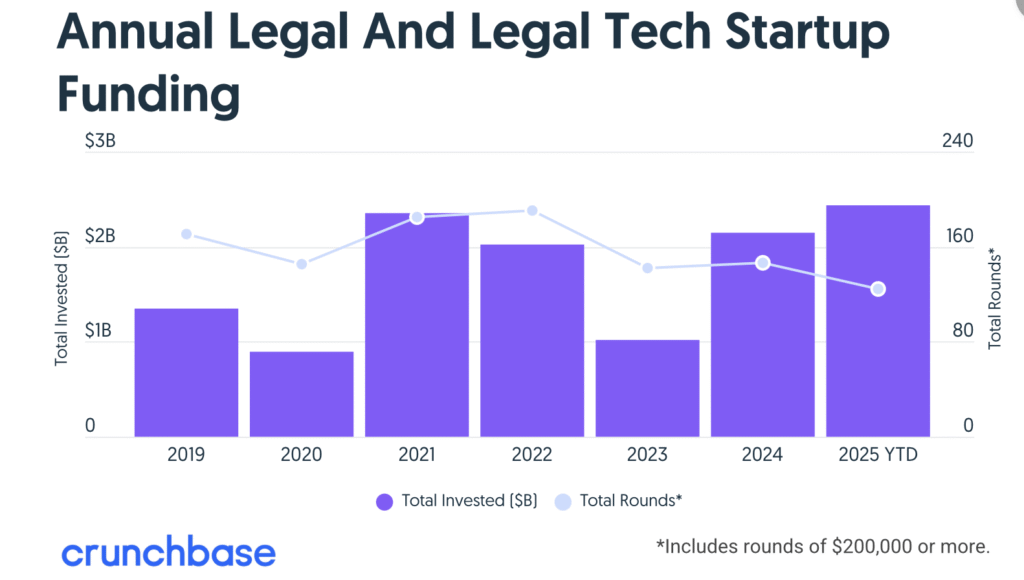

LegalTech investments break 2021 record

$2.43B are invested in LegalTech startups in 2025 so far, surpassing the $2.35B record from 2021.