Innovations in Banking Technologies

Digitalization is having a massive impact on our lives in the 21st century. It alters industries forcing them to either accept the innovations or stay behind competitors. A special role in this process is assigned to the banking sector, which is at the forefront of introducing new digital banking innovations and solutions into its field of operation, which will further serve as catalysts for digitalization in other sectors of the economy.

The world of banking is undergoing a historic transformation. New technologies are designed to meet the growing expectations of customers who are demanding and picky regarding financial services. Clients expect quality service, which prompts banks to strive for improvement and enhancement of what they can offer to meet growing demands. Many banks are resorting to app and web development services to create and implement advanced solutions. In this regard, the quality of banking services, the number of new banking apps, and the speed of their delivery to the consumer have increased recently.

TOP 13 Innovations in Online Banking

From IoT to Blockchain and AI, all advanced technologies are increasingly used in banking to make users’ lives easier and more convenient. Let’s take a deeper look at the digital banking innovations that allow for more enhanced services.

APIs

The importance of APIs has grown exponentially in recent years, playing an essential role in the banking and finance industries. APIs provide a more powerful means to share data and deliver personalized services. Through APIs, banks can provide their users with secure access to their finances through third-party platforms. It also helps companies build banking-powered products.

Flexibility, streamlined financial services, competitive edge allowed banks to accomplish the following:

- Reduce the intimidating administrative hurdles that may typically prevent users from receiving loans;

- The capacity to generate real-time insights on cash flow, cash position, and more, across borders;

- A complete view of all financial activities in a single place with the ability to control, track, and analyze.

Real-Time Payments

With the increasing demand for immediate payments, systems worldwide need to either meet this request or be kicked out of the market. Customers are requiring more convenience and security services and processing all their transactions with rapid, instantaneous results.

Real-time or instant payments are the latest banking innovations that are becoming the new norm, the catalyst for the most vital transformation in the global payment panorama.

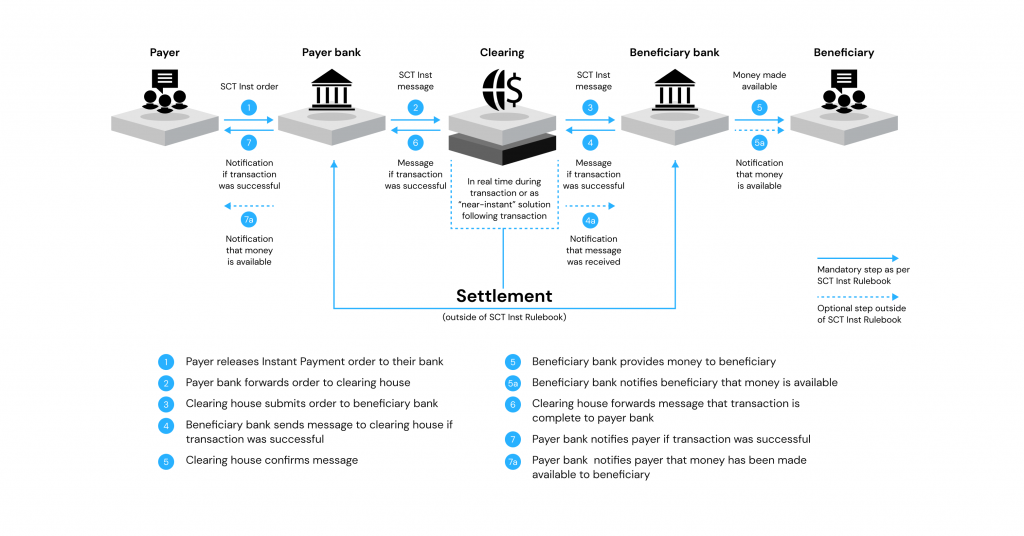

This is how Deloitte portrays the instant payment process:

What value do real-time payments bring?

- Speed: Instant access can transform a business or a specific project when it deals with a matter of urgency.

- End-to-end communication: Real-time payments allow the credit card data to be collected, matched, and sent together in a single transaction.

- Efficient payment route: Instant payments are meeting liquidity needs and providing more financial control to clients.

- Irreversible payments: Real-time payments are irrefutable, meaning that once the transaction is complete, there is no way to reverse it.

Cloud Technologies

The capabilities of the latest banking innovations come in handy in an increasingly digital age, in which customers demand enhanced digital experiences from companies. Cloud computing has democratized and increased data processing capacity and security, allowing small and big banks to gradually update their outdated systems and succeed in web development. By relegating most services to the cloud, financial institutions can move faster and manage the scales of their operations with greater efficiency.

Although most fintech and digital banking services organizations have not yet deployed their core systems to the cloud, the majority of them are planning to make this move. Banks are hesitant to rush into this new technology due to the complexity of the deployment, the risk associated with it (governance, security, and control). The IBM research states that 91% of critical banking workloads are still housed in an on-premises data center.

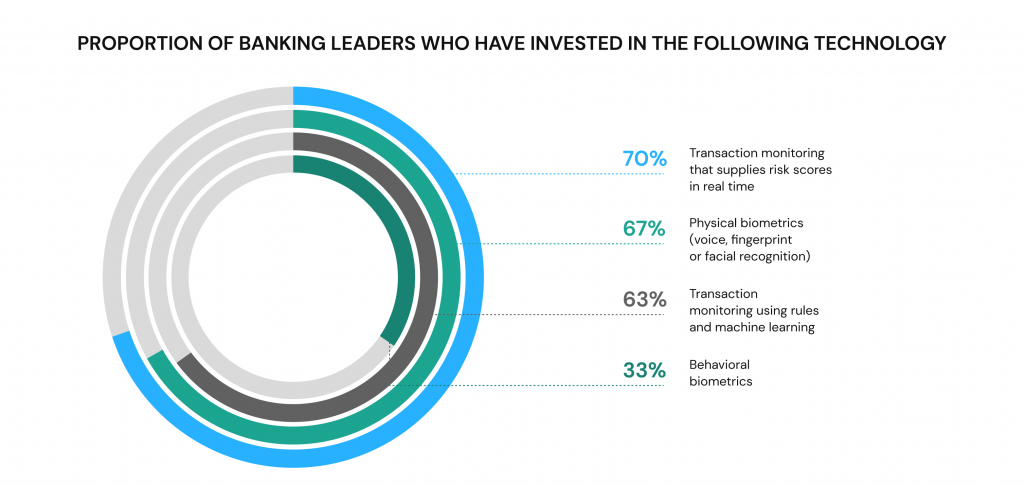

Biometrics

The future of authentication technology in banking can be summed up in one word – biometrics. Biometrics is an important digital banking innovation used to identify individuals based on their physical and behavioral characteristics, unique to each individual. Although not yet ubiquitous, many market leaders are already actively adopting the use of physical features (fingerprints, voice, face, keystrokes) for automatic recognition. Identity authentication will increase the reliability of banking operations and help prevent fraudulent activities. Also, after passing the identification, banks expect to offer customers individual services much faster.

Some banks are considering using technologies for recognizing visitors not only by their faces but also by their gait while navigating the building and to identify the client’s emotions to assess the quality of service.

Biometrics is a critical step towards digital transformation for PFIs facing today’s mobile security realities. For instance, in addition to fingerprints, AI reads a set of unique face characteristics that do not depend on hairstyle, glasses, makeup, and other factors. This technology is called a biometric face descriptor: it cannot restore the original face image, and therefore the data is considered impersonal and protected from fraudsters. In addition, the program recognizes a voice by 70 parameters while correlating speech with facial expressions. This eliminates deception using a pre-recorded voice.

Also, in some banks, AI can identify a person by the speed of typing on the keyboard. Another way to use biometric technologies is to authenticate the pattern of veins in the palm: scanning is carried out using infrared radiation passing through the tissue of the hand. In addition to combating fraud, biometrics helps the fintech and digital banking clients access remote services requiring identity verification. For users located in remote regions, it gives a choice of the best deals in any bank, regardless of their territorial remoteness.

Chatbots

To speed up and facilitate communication between an employee of a bank and a client, banks began to use chatbots, simulating a dialogue with a user, thereby reducing the need to use channels such as telephone or e-mail. Chatbots that answer standard questions help lessen the load on call centers, keep any client on track and expand the bank’s capabilities in additional communication channels with customers, which, in turn, improves the quality of service.

The chatbot market is growing by 25% annually, and the chatbots themselves process 50% of requests. Chatbots technologies in banking are able to connect to the clients’ financial transactions database, analyze income, expenses and offer to accumulate, save or replenish a savings account. You can now buy air tickets, pay utility bills or place an order in a store after a minute of conversation with a robot and one click in the app.

In addition, chatbots notify customers about new banking products and ongoing promotions and provide information about exchange rates. This method of communication operates 24/7 and provides quick access to information for users who use instant messengers (programs for a smartphone or personal computer designed for online communication).

Process Automation

The development of AI technologies is skyrocketing and finding its application in more and more industries. Banks are becoming conglomerates of vast amounts of The development of AI technologies is skyrocketing and finding its application in more and more industries. Banks are becoming conglomerates of vast amounts of information, and now we see rather intense competition in the banking segment. Digital banking innovations allow for further reduction of costs and increased profits. Therefore, AI and its correct application in terms of targeting banking products is now the focus of financial organizations’ attention and is one of the most significant innovations in online banking.

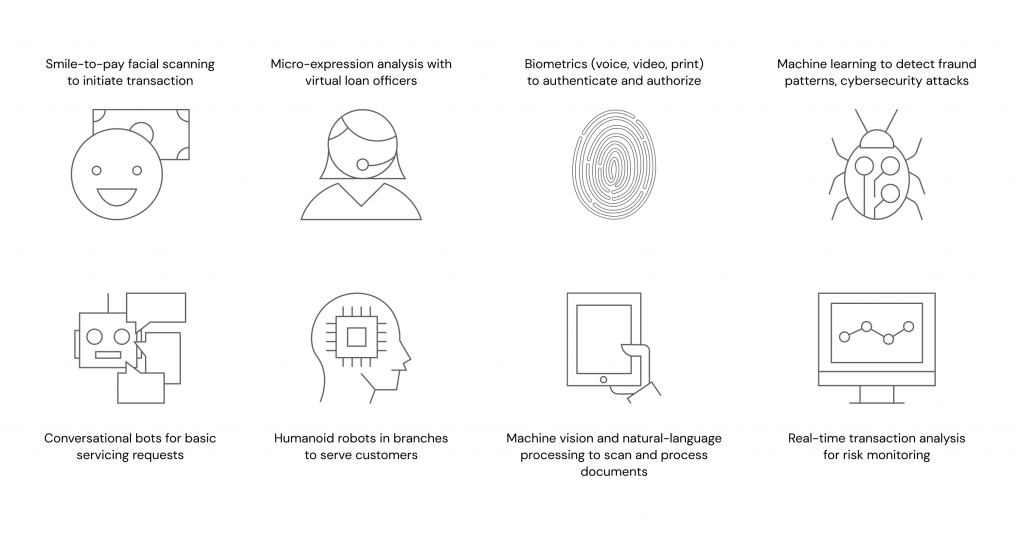

AI

According to PwC, most financial leaders invest in AI. 52% of CEOs invest in AI, 72% believe it will be a commercial advantage. AI is already creating a completely new market and has a positive effect on the client’s interaction with the bank. The technology is used in transaction accounting, fraud detection, reporting, and planning because it makes decisions faster and makes them more accurate and cheaper than a human.

AI is able to predict the desires of a person, based on the information that it possesses and this allows banks to fine-tune the personalization of customer interaction. The client, opening the mobile application, will see relevant proposals for actions (important functions, necessary reports, current spend analytics, etc.).

McKinsey highlights the following utilizations of AI in banking:

AI technology is aimed at solving many problems, the main one of which is the adaptation of banking instruments to the wishes and needs of financial institutions’ clients and the personalization of banking products and services. The use of this technology makes it possible to simplify the data collection system, recognize and analyze speech and video, use neural networks and biometric identification.

AI is also actively used to determine credit scoring (a method for assessing the creditworthiness of bank customers based on numerical statistical methods). For example, these technologies set the credit limit acceptable for the client based on the automatic analysis of the borrower’s data, after which the financial institution, based on this information, adjusts the loan amount.

OCR

One of the latest banking innovations is OCR. Most banks use optical character recognition or OCR in their activities to digitize customer service workflow, work with counterparties, and archive documents. OCR technology processes large amounts of text and translates the image into an editable format. OCR software scans documents and automatically checks the correctness of their filling, and then sends scanned images to the bank employee for verification. After successful completion of verification, the scanned documents are saved to the archive and can be further used in the bank’s information system.

The latest mobile OCR and scanners are easily integrated with iOS, Android, and web platforms. The benefits of this technology include automating processes and reducing human errors, ensuring high accuracy in document scans. OCR technology enables document comparison in an efficient manner, speeding up loan processing by up to 70 percent.

Microservices

Instead of the traditional version of the monolithic architecture, making it difficult for banks to grow beyond a certain point, banks are moving to a more advanced model. The microservice architecture enables the application to be split into many different pieces. The applications are divided into independent parts that operate separately from one another. And there is their unique secret: the way that the microservices approach eliminates the concerns that arise with conventional apps is that it is not limited to single server software.

Take a look at this scheme of one microservice architecture of the bank:

How do banks benefit from it?

A change in one part of a traditional application may affect the operation of the entire app. With microservices, everything is different. No changes to one module or function affect other functionalities or modules; each module and function is independent and able to work independently. This type of architecture enables frequent changes and updates to be made, minimizing both the probability of failure and the lead time of tasks completion, making iOS or Android app development easier.

Other benefits include:

- Increased processing speed;

- High scalability;

- Superior security;

- Enhanced performance;

- Customizable functionality;

- Simple integration.

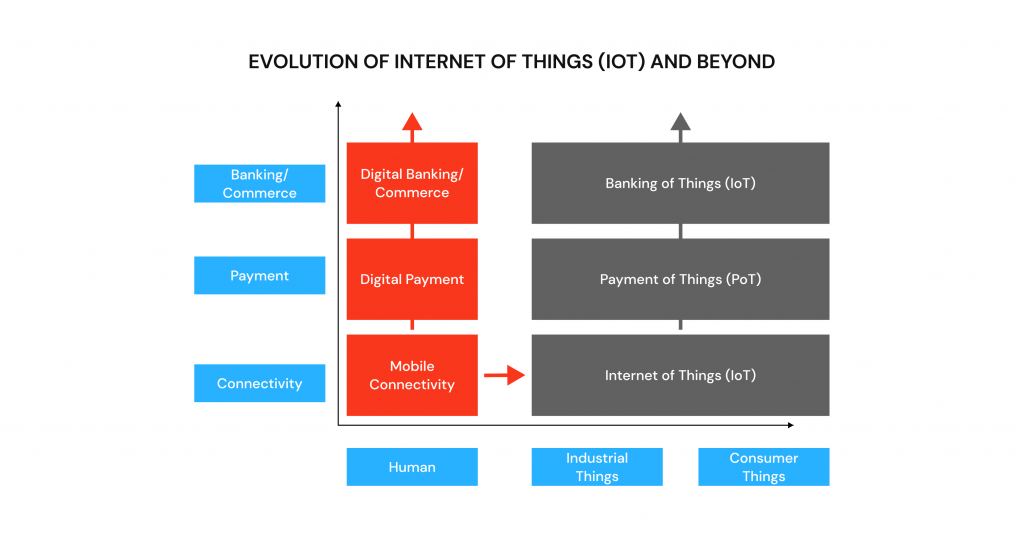

Internet of Things

A network of internet-connected devices that collect and transmit data is called the Internet of Things. As the world reaches 4.66 billion people accessing the internet in 2021, the IoT can truly provide fantastic changes to many industries, including new exciting developments in banking.

The potential use of embedded finance is becoming highly prevalent, and the many innovations and advancements in smartwatches and sensors throughout the home are beginning to show how we can see this trend take place further. From the wearable set on the horizon to the smartwatches and other related devices foster a connection between your bank account, your smart devices, and the privacy of your home.

As fintech and digital banking innovations evolve, banks are looking to integrate new ways to improve their services. IoT offers a range of benefits for credit cardholders, including a more reliable and instant banking experience. Banks can also predict credit card fraud and debit transitions, giving them an opportunity to evaluate their security.

Big Data and Advanced Analytics

Banks invest tens of millions annually in collecting, storing, and processing Big Data. Fintech and digital banking institutions operate with a huge amount of data: debit card transactions, ATM cash withdrawals, credit history, and much more. Banks use big data to study customer habits and segment them, manage sales, assess risks and analyze competitors.

Tools based on Big Data analysis allow you to process significant amounts of information coming from different sources in any format. Big Data technologies make it possible to store, research and receive correct information about the “digital footprint” left by all Internet users, which, in turn, allows banks to form personal offers for their customers, effectively allocate resources and form a digital strategy.

BD analysis allows you to divide bank users into segments in accordance with specific profiles, which are compiled using these technologies based on the customer spending model, and identification of transaction channels. BD technologies also help to understand the structure of expenses and the previous credit history of a client. Financial organizations use this to assess the risk when issuing a loan.

Enhanced Consumer Experience

Over the past several years (and especially the past two), many developments in banking were focused on the complete transition to mobile banking. For many financial service users, this is the path most often used to obtain the necessary information or conduct individual transactions. The share of customers using a mobile application or an online bank on an ongoing basis is constantly growing. This means that the comfort and functionality of mobile banking applications will become the basis of competitive advantage in the coming years.

Modern users are technologically advanced, require a personalized attitude, and are very impatient. Their priority is not the channel of communication with the bank, but the instant availability of services, the possibility to resolve the issue 24/7, and the safety of operations.

This is what modern banks are working on. They strive to reduce the cognitive load of their users, make access to finance more convenient, and transactions even faster. That is the only way they can stay in the market and stand against the competition.

Human Digital Banking

Today, users need something more than a mobile digital bank, they need the personal accompaniment of a living person. That’s the human-focused technologies in banking that have appeared in the finance industry recently and that is what users require now.

A new approach to banking called Human Banking focuses on providing digital banking with an accessible, understandable, and personalized experience. With human banking, each client can choose a personal banker that meets their financial needs, regardless of the account balance. One simple step for banks to take towards embracing a more human strategy is to provide their customers with fun SMS verification codes instead of numeric ones. As a result, the customer will perceive a greater connection with the process and will remember the temporary password more quickly.

Apart from offering assistance-related facilities, human banking is a kind of social commitment. It is great because it is all about understanding that money is a very sensitive asset. The difficulties of its management can hinder clients’ plans and goals. Human Banking aims at providing all the benefits of digital transformation in banking, ensuring safety, trust, and human interaction at the same time.

Voice Recognition

Robots and virtual assistants perform routine and time-consuming tasks without human intervention accurately and quickly. In addition, the conversation with the robot can be personalized. In the coming years, chatbots might be managing 85% of client requests.

The voice interface is not that easy to develop and deploy though. It requires a whole set of add-on solutions: deep links to open screens with products, complex integration for executing commands, self-learning engines for dialogues, voice recognition tools, etc.

Blockchain

If you are a part of the banking industry, staying on the cutting-edge is paramount to success. One of the most recent technologies that banks are implementing is blockchain. In 2018, Deloitte conducted a survey that revealed the curiosity and excitement of the banking industry towards Blockchain technology. One thousand of banks took part in the research which ultimately revealed their trust in blockchain and the security it offers. In fact, 84% of respondents consider it to be more secure than traditional solutions, and over 95% claim they are willing to invest in the technology.

Blockchain and distributed ledger technology have been used for financial and business use cases and have quickly spiraled beyond cryptocurrency use. From logistics to healthcare to solar energy, blockchain is everywhere, and of course, it hasn’t gone past the banks. The blockchain provides support for hosting, integrating, and managing various financial transactions, which is why it could provide transparency to many services that are currently administered by third parties. By moving away from intermediaries, blockchain can make money borrowing more secure and provide lower interest rates.

By storing customer data on decentralized blocks, blockchain makes sharing information between financial institutions more accessible and safer. Several Canadian banks, for instance, use blockchain technologies in banking to allow users to control and manage data they provide to financial institutions.

5G

The speed of data processing and customer engagement becomes more important as digital transformation in banking gains momentum and full steam ahead. With the advent of 5G technology, data transmission and connectivity will continue to be exponentially faster and uninterrupted, enabling a whole new way for business growth and innovation.

5G will offer faster and more user-friendly payment options that will make mobile and digital transactions even more of a popular choice for many consumers. Faster 5G networks will help banks perform more complex tasks much more quickly. Thanks to this speed increase, banks will be able to combat any malicious behavior or fraudulent activity in real-time.

Final Word

Digital banking innovations are changing the relationship between customers and banks, improving financial services, and lowering the cost involved with customer transactions. Implementing the above-mentioned innovation in online banking is an essential facet of the transformation of the entire industry. To increase the positive effect of innovations, it is best to introduce digital developments in banking gradually, mastering related industries, increasing the speed of product improvement, while focusing on data security.