How to Build a Fintech Startup?

We live in the age of the fintech startup boom. Some even call it the gold rush of our time. Between 2020 and 2021, more than 5,000 fintech companies have emerged around the world. Such interest in this industry is more than understandable. There are eight fintech companies on the list of the world’s top 20 nonpublic unicorn companies. In the first quarter of 2021 alone, fintech companies worldwide raised $22.8 billion — twice as much as the quarter before, according to business analytics platform C.B. Insights. In the U.S. alone, fintech companies raised $12.8 billion in the first quarter of 2021, a 220% increase over the same period in 2020. According to Forbes, the average valuation of the 11 largest U.S. fintech companies as of June 8, 2021, is $19.5 billion, double last year’s average.

By 2020, the valuation of the most prominent U.S. fintech startups has doubled or even tripled. Twenty of the companies on the Forbes Fintech 50 list are newcomers; most are personal finance companies.

The success of the best new fintech companies impresses and motivates many people to create and realize their fintech ideas. However, a logical question arises: how to find a place in the sun and how to build a fintech startup in the face of fierce competition?

There is no single answer. Every company has had its way of success. However, there are several key points. You can increase your startup’s chances of success and bypass the most common mistakes by considering them. Our experts have compiled them in this article in the form of a short guide.

Let’s get started.

13 Steps to Create a Fintech Startup

For your fintech idea to successfully transform into a successful product that raises millions of dollars on each round, you, as its creator, must conduct careful planning and develop a business plan for your project.

Creating a fintech startup can be divided into 15 steps, the ways of implementing which you should think about in advance.

Consider the Target Country

An obvious point, but this is the reason why startup founders often overlook it when planning: where exactly to register a new company to create their fintech project?

Selection criteria you should consider:

- What market are you focused on: sometimes, it makes sense to open a company where you will work. For example, to open a business in the Netherlands to operate in the E.U. However, it can be more profitable to open a company in the United States, then get additional licensing in Europe. The bottom line is the potential to enter two significant markets at once.

- Taxes — high, low, benefits or lack thereof are also worth considering.

- In the regulation of I.T. and fintech spheres in the country: do local laws protect your interests, and what is the actual practice of companies in this area?

- Consider the cost of maintaining the company relative to the potential benefits. It is cheaper to open a company offshore account and get a license for it. However, it is not easy to open an offshore account — all transactions will be constantly monitored, interfering with regular business. Sometimes it is more advantageous to register a business in a high-tax country, but with an excellent reputation and other advantages.

Some examples of popular countries for starting a fintech company:

- Malta

- United Kingdom

- Estonia

- Lithuania

- USA

- Ireland

- Hong Kong

- Singapore

Identify your Niche

Fintech is a flexible and heterogeneous industry. You can create a substitute for a bank or a cryptocurrency trading mobile app, or maybe your goal is a SaaS platform that will provide accounting services or financial advice.

When developing your project, it’s worthwhile to decide in which direction you want to operate.

- Digital wallets and payment systems

- Cryptocurrency exchanges

- Currency exchanges (including cryptocurrencies)

- Blockchain-based financial solutions

- P2P lending

- International Money Transfers

- Insurance products and services

- Identity protection

- Proprietary neobank

Fintech startups can provide top-notch solutions for the same problems that traditional banks solve, but do better, more cost-effectively, and provide a more convenient user experience. This is the first scenario for a business fintech application. The second is a search of the entirely new uncovered customers’ needs that banks did not previously offer or provide this service to a narrow list of privileged customers. This could include personal financial advice, investments in stocks and bonds, etc.

Get to Know the Legal Regulations

Fintech and banking are some of the most highly regulated industries. For this reason, you feel like a fish in water when it comes to laws, regulations, requirements, and restrictions from regulatory bodies. The latter became especially important after the General Data Protection Regulation (GDPR) was adopted in Europe in 2016. It is worth noting that in the United States, there is no single analog to GDPR. Several separate regulators perform the same functions altogether.

GDPR is a universal regulation that must be strictly complied with by any company interacting with customer data. However, this is only a tiny fraction for companies in the financial system. For example, in the U.S., every Fintech company also has to follow Anti-Money Laundering regulations (AML) and Financial Modernization Act. Moreover, your fintech startup will need to obtain a license in each state. Add to this the use of digital certificates and other standardized high-security authentication mechanisms, and you get an impressive list of norms and standards.

If you plan on starting a fintech company in several counties once, the scale of the task increases in proportion to the number of countries. It is highly recommended to contract highly qualified legal professionals with deep expertise in regional and international laws and regulations. Otherwise, your product may not reach the end consumer due to legal delays.

Determine your License

A license is a document from a country’s authorities that allows you to work legally in finance. There are many types of licenses, we listed some of them below.

The choice of a particular license depends on:

- Price

- The amount of preparatory work

- The range of services you will be able to provide

A few examples of the types of licenses you can get in different countries.

- Cryptocurrency exchange license – allows you to exchange fiat currencies for cryptocurrency and vice versa.

- E-wallet creation license — in addition to exchange, you can create wallets for storing electronic currencies.

- Financial Institution license — you can choose activities from the list, including brokerage, client advisory, leasing, etc.

- E-money Institution license (EMI) allows you to issue e-money and everything in the following license.

- Payment Institution license (P.I.) enables you to make payments, issue payment instruments, carry out currency exchange, process card payments, and so on.

- Insurance broker license

- The license of a credit institution (bank)

- License for the establishment of investment funds and firms

What’s Different About Your Fintech Startup?

In a nutshell: How is your project different from others? A payment system is a trend, but why should users choose you? How will your fintech startup solve the client’s issues and allow you to earn hundreds of thousands and millions? How do you plan to develop your service in 3 years? And in 10 years?

Find Competitive Advantages

There are two working approaches on how to start a fintech company. Many startups grow out of a desire to solve some personal problems and gradually become large companies. The other case is that you, as an experienced professional, can recognize the market’s needs for this or that solution in a way that no one else has offered before. Sometimes the difference between an existing solution and an innovation can be minimal. However, in the end, it can result in millions of users around the world.

One might get the impression that fintech is a cornucopia in terms of business opportunities. On the one hand, it is. Finance is one of the most conservative industries, so there are still many vacant niches regarding digital transformation capabilities and innovations. However, this industry is dominated by big-name giants like Microsoft and a few already highly successful fintech startups (Stripe, Coinbase), which makes it an extremely competitive market. Expecting easy success or relying on luck is a sure-fire way to nowhere.

To survive on this battlefield and disrupt the industry, you need to understand your potential customers and their pains clearly. The provided solution has to solve their pain points and does faster, more efficiently than existing analogs. Before you hire a team and start to build a fintech solution, you need to recognize your competitive advantages and communicate their value to the end customer.

Hire a Team of Experts

To create the software, you need a qualified development team, preferably with experience in the fintech domain. However, high-quality product implementation is only half the battle.

For your fintech startup to skyrocket, it is vital to have experts in finance on your team. If you are such a specialist, you are fortunate. Otherwise, without an expert who knows all the intricacies and industry’s peculiarities, the chances of success are significantly reduced.

Sometimes it’s worth investing resources in a particular specialist, and he will give your company a fairy-tale boost. You will only have to guide people, remind them of your vision and adjust the entire business course. Remember that a team leader and main enthusiast here is you. An engaged and motivated team of professionals will launch any project into the stratosphere. With exemplary leadership, such a team can move mountains.

Choose Funding Options

Now, you have a clear plan, estimated cost of your product, and have gathered a team of experts. However, the question of financing remains unresolved. Where can you get the capital to launch a fintech startup?

Nowadays, startups have a massive range of opportunities, starting from bootstrapping and finishing with borrowing from your friends.

These are the top 10 options for raising money:

- Self-Funding / bootstrapping

- Friends and family investors

- Crowdfunding

- Incubators / accelerators

- Angel investors

- Venture capitalists

- Bank loans

- Business grants

- Partnership / licensing

- Commitment to a major customer

Regardless of which way to get startup capital appeals to you more, it’s necessary to prepare a solid arsenal of arguments to convince potential investors of the relevance and profitability of your idea. A great way is to develop a visual prototype of your solution. If this is your second or third round of investment, a developed MVP is also a great pitch.

Choose the Tech stack

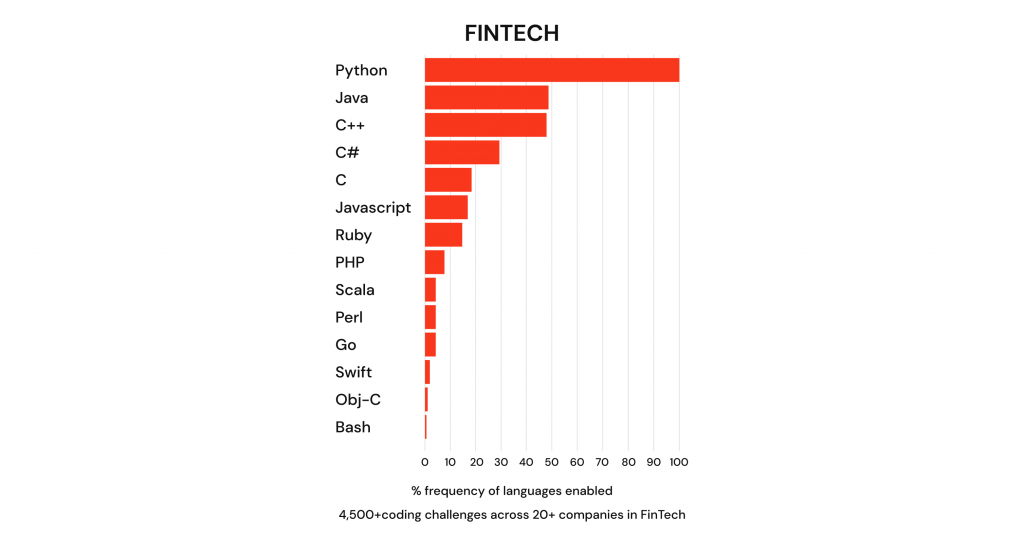

It is hard to identify any particular programming languages or frameworks that would be optimal for fintech startups development. According to HackerRank, Python is the most frequently used programming language. However, It all depends on the product’s concept, the complexity of its functionality, and the tasks it has to perform.

If you outsource your software development process to a proven and experienced company, it is worth trusting their solution architect. The expert will analyze the requirements and tasks of the application and propose the most suitable tech stack that will secure a reliable and fast solution within your budget and deadlines.

You should pay attention to the use of Artificial Intelligence, Big data, and other top-notch technologies. Firstly, their use can become an additional competitive advantage. Secondly, the same AI reveals the enormous potential of analytical and predictive capabilities.

Major technology trends in fintech app development

The list of booming technologies increasingly used in fintech applications includes:

Artificial Intelligence

AI has found many applications in the context of fintech tasks. The primary mission of AI solutions is to analyze large volumes of data in real-time and identify common patterns and anomalies. Anomaly detection is often used to prevent unauthorized access, fraud in insurance and banking, and forecasting in securities markets.

Blockchain

Blockchain is a highly reliable decentralized system for recording and storing data. Blockchain-based solutions are characterized by complete transaction transparency. Once a transaction has been made, it remains forever in the registry. Nothing can delete or correct it, as it is stored on the computers of all blockchain participants simultaneously. All cryptocurrencies are based on this architecture because of security.

Big Data

Huge companies daily process terabytes of data. Big data solutions make it possible to benefit from these vast flows. The deep analysis allows you to extract a wealth of insights for business development. For example, by analyzing the data, you can better understand the demands and requirements of your audience. On this basis, you can add new features to your fintech application and get ahead of the competition.

Cybersecurity

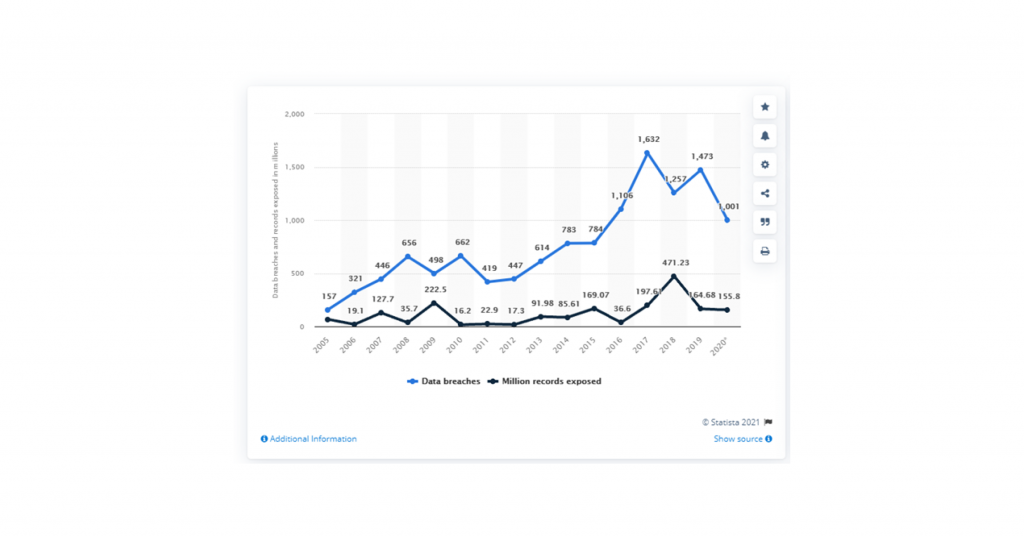

Data security in fintech applications is an ever-growing problem in the digital world, the relevance of which we touched on in the article.

Microservices

Until recently, the use of microservices had its boom, and it was tried wherever it was suitable, and not very much. As for fintech, microservices architecture has found its application here due to its decentralized nature. Applications can quickly expand functionality and integrate new services into the overall infrastructure.

The use of the technologies described above will increase the efficiency of your solutions, increase user interaction and reduce the cost of developing your application.

Build and Improve your Fintech Startup

All the previously described steps have involved planning, analyzing, setting up processes, and assessing risks. We can compare them with a pre-flight preparation. If you’ve done everything right, a crew only has to launch your product into space.

Development is a kind of runway and flight. While the team builds the app code and creates the design, it accelerates straight to its release.

After that, the flight phase begins. You have to monitor the performance of your fintech app, constantly optimizing internal processes and functionality and implementing the latest trending technologies, constantly advancing the solution. Once you get the startup off the ground, unfortunately, you cannot turn on the autopilot. Otherwise, it will fall to the bottom of the market or crash altogether.

Start with a Minimum Viable Product (MVP)

The main recommendation that most startups follow is to iterate the product creation process. Don’t try to create a ready-made product with all the features right away. The best starting a fintech company is the development of the MVP. Once you are sure that the application is successful and that the flight is OK, you can build up the functionality further to take your business even higher.

Security in Fintech Solutions

Given the growing number of cyberattacks, data security is one of the most critical aspects of creating a fintech startup. Such applications interact with a massive amount of sensitive customer information. In addition to personal data, this includes payment cards, access to other valuable assets such as stocks or cryptocurrencies.

To ensure a high level of security for your customer’s data and your peace of mind as a fintech startup owner, hire mobile development professionals. Often, most vulnerabilities appear due to errors in the development process. Following guidelines and best practices from OWASP and other globally recognized institutions provides a solid armor against most potential threats. Suppose you’re not a pro in this area. In that case, it’s best not to skimp on finding and contracting experienced developers to build security-intensive solutions.

Consider possible integration with third parties

You have to consider which third-party services or products your app startup company will integrate with and agree on their providers in advance. In today’s world, almost no software products and services can exist in complete isolation from the internet. At a minimum, your users need to link their credit cards and make transactions with their assets. Integration with the most well-known payment systems and financial services like Visa, Mastercard, etc., is at least your app needed.

Advantages of Starting a Fintech Company

Despite all the difficulties and the highly competitive environment, the number of fintech startups is constantly growing. There are many reasons for this. Let’s look at what they are.

High Demand

Almost every smartphone owner has at least one fintech app installed. This indicates a huge demand for this kind of solution. Users want access to their finances 24/7, 365 days a year. From banking clients, securities, and cryptocurrency trading apps to investments and mobile insurance offices and more, the digitalization of money is growing at a tremendous pace.

The main advantage of fintech startups is that you have a vast audience of potential customers, which rarely happens to startups in other markets. Moreover, you don’t need to demonstrate and prove the benefits of your innovation.

Accessible Expertise

Every year the creation of fintech startups becomes faster and more accessible from the technical point of view. Developers gain experience in this industry, best practices, recommendations, profile technologies, and tools appear. More and more information about the structure, regulatory processes, and requirements to fintech solutions from official sources appears in the public domain. It significantly simplifies a career in fintech, making the whole process more transparent and clearer.

In addition, banks and financial institutions increasingly support the digitalization of the financial industry and enable fintech startups to interact with their services via special APIs.

A Wide Range of Developmental Possibilities

Fintech solutions have broad potential for continuous growth and development. This can be an expansion of the set of features and services with which your company integrates, as well as the implementation of artificial intelligence and other advanced technologies. The latter is excellent as competitive offerings. If you were a user, would you choose a trading platform where AI tells you the trends or a common platform where you have to do everything yourself?

Incorporation into Enterprise Infrastructure

Fintech applications are attracting more and more attention from enterprises. Large companies also have many unmet needs in the area of financial processes. Optimization of transaction creation, deeper analytics, and insights cost reduction and management, forecasting, and more. If a fintech idea can cover the needs of industrial giants, you will have no trouble getting funding to implement it.

A Wide Range of Technology to Leverage

Today’s financial technology is one of the industries that are pioneering new technologies. Artificial Intelligence, Big Data, the Internet of Things, all of these have already found their place in finance.

Your fintech startup can be based on one of these technologies or a combination of them, allowing you to create a solution that no one else is offering users.

The Rise of Cryptocurrency

Digital currencies have already become part of our daily lives. More and more companies are willing to accept payments for their services using them. Moreover, users often choose to store their savings by converting them to known cryptocurrencies. To do this, they need to build a simple, straightforward, and, most importantly, reliable platform. Without a doubt, this market is already stuffed with numerous players. One might get the impression that a new fintech startup won’t compete with monsters like Coinbase or Binance. However, if users were satisfied with at least one app, they would not look for alternatives.

Offer users what the market mastodons are missing out on, and you’ll quickly find yourself among them.

Platforms and Fintech SaaS solutions

Many companies do not want to bother with building internal financial solutions, so they are looking for platforms that can manage and automate their accounting and financial processes, offer analytics and decision-making assistance. A SaaS solution is a profitable and efficient way to provide financial services for clients and providers. That is why many fintech companies choose this model.

Open APIs

More and more banks and other large financial institutions are connecting to the global digitization of the financial industry. They are providing open APIs so that any company can get some access to their services and data. This is not only well-intentioned, there is fierce competition among banks, and they are also looking for additional benefits to get users on their side.

Avoid these Mistakes while Launching a FinTech Startup

This section has collected the top 3 mistakes, which are often the reason for the collapse of seemingly promising fintech startups.

Ignorance of the Product, the Market, or the Consumer

You may know your product, your market, and your customers. But many fintech startups face difficulties to combine these components as a whole.

About 42% of young companies’ failures are due to a disastrous lack of knowledge of the market they are trying to enter. Finally, a brilliant idea can only be brilliant if paying customers also think so. According to a study published in Forbes, nine of the top 20 reasons startups failed were related to customers: not meeting their needs, not listening to them, and even ignoring them. Take the time to master data and analytics and truly understand your customers, behavior, and needs.

Remember, your product should be a solution to a problem, not a solution that looks for a problem.

Lack of Necessary Expertise at all stages of Funding

Funding is an essential step in the startup process. As fundraising requirements increase, so does the deal’s complexity—many organizations provide the necessary expertise to address these issues.

A highly qualified advisor who can establish a dialogue with the right investors will help you deal with the shortcomings of your business and present your startup in the best possible light.

Poor Implementation

Founders can make all of the above points ideally, but it will all be in vain if they fail to execute their vision. The key is to keep the startup flexible, stay innovative and relevant, and implement repeatable processes to ensure scalable and predictable growth.

You may have been pushed down this path by personal skills and talents. However, it’s systematic processes and a high-performance team that will ensure your company survives, thrives, and scales.

The right idea, the right expertise, and the proper management prove that nothing is impossible. If you can learn from failures, and considering that 90% of startups fail, there’s something to remember. All founders striving for success should be aware of these typical mistakes and learn how to avoid them.

Summary

Fintech is a promising niche in the next few years. But to survive in the competition, you need to prepare and prepare thoroughly. But the strongest will get the biggest prize.

As you can see from the article, one of the success factors is a dedicated team of professionals, so please get in touch with Ein-des-ein experts to get qualified services on any type of software development.

Mini-FAQ

What is a fintech startup?

A fintech startup is a project, or even a business idea, aimed at closing any need of users in finance. As a rule, a fintech startup implies a software solution of any type, usually based on the latest technologies, offering a brand-new product or a solution to the current problems more efficiently, faster, and often cheaper than the existing offerings on the market.

What are the types of fintech companies?

Fintech companies can be divided into the next types:

- Digital wallets and payment systems

- Cryptocurrency exchanges

- Currency exchanges (including cryptocurrencies)

- Blockchain-based financial solutions

- P2P lending

- International Money Transfers

- Insurance products and services

- Identity protection

- Proprietary neobank

What could you name as the best fintech startups and applications?

Great examples of startups that have become rockstars in different areas of fintech are:

Online payments — Stripe, Paytm, Klarna

Peer-to-peer lending and financing platform — Lufax

Personal finance management — Mint

Investments and trading — Robinhood

Insurance — Oscar Health

Digital currency exchange — Coinbase