Types of Fintech Companies

In the world of finance, there are many specific terms that we may not be familiar with. But one of them is closer to our daily routine than you think – we are talking about fintech. From purchasing groceries at your local supermarket using a preferred e-wallet to utilizing online banking solutions anytime anywhere. No doubt, the financial services industry is experiencing great changes as new projects and startups continue to offer smarter, quicker, more convenient ways of managing our finances. And the fintech sector is not limited just to that only! Cryptocurrency and digital cash, Blockchain technology, Insurtech, robo-advisors are among modern innovations that have already been influencing the financial processes of many organizations around the world.

With mobile payment solutions, investment tools, and other alternatives to traditional options, chances are high that we won’t need traditional banks at all in the future. And, of course, numbers speak for themselves: from $4.1 trillion in 2019 to $5.2 trillion in 2020, the overall transaction value of digital payments visibly increased. More than 70% of financial institutions globally are planning to implement the latest innovations to enhance client retention. And by 2022, the fintech sector is estimated to be worth $310 billion.

Nearly 1,6 billion “unbanked” people globally still do not have bank accounts and access to financial products like insurance or loans, fintech has the potential to solve such a global problem. Based on these facts, the industry is expected to grow by leaps and bounds going forward.

So, what is the definition of a financial technology company, and what types of them are gaining popularity and receiving investment right now? In this article, we will answer common questions regarding these projects and give you examples to be inspired by.

What is considered a fintech company?

Fintech describes various innovative solutions aimed to improve and automate financial services delivery. From large companies to individuals, it helps to manage different financial operations; depending on the aim, B2B and B2C products and tools are created for both PC and smartphone users.

Fintech has changed meanings over time, once referring to banks’ backend instruments, today’s usage includes consumer-focused applications too.

Speaking about fintech companies specifically, fintech defines organizations providing various kinds of financial and related services via software: from online banking to cybersecurity and anti-fraud projects aimed to prevent cybercrimes/data leakage.

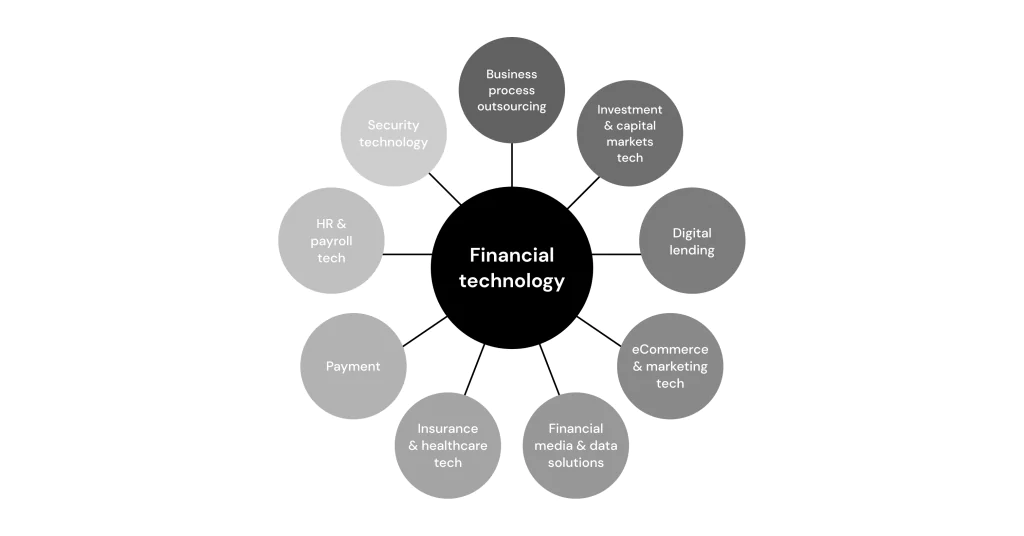

Common categories of Fintech companies

Fintech companies employ technology to support transactions among businesses and their partners (B2B) and consumers (B2C), both markets attract new players, specializing in:

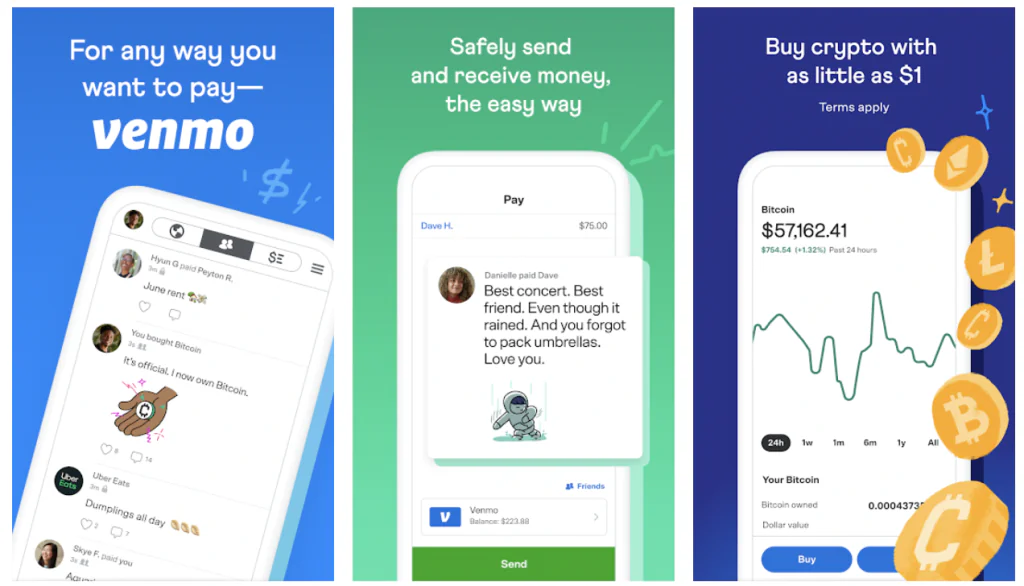

Mobile Payments

Most of us use Apple Pay, Google Pay, or other forms of mobile payments on a daily basis. Cash is definitely losing popularity, especially in our post-covid reality, and startups can enter this growing segment with various ideas. A good example to look up to is Venmo. If a user wants to split bills with friends or family members, e.g. for groceries, he/she can transfer or receive funds via this mobile app. Besides that, Venmo QR code is utilized for touch-free payments at stores; users are also able to check out with Venmo on some apps like Grubhub.

Is it worth investing in similar projects? Just speaking about Venmo only, 65+ million people use the Venmo app on a daily basis. In the Q2 of 2021, their total payment volume grew by 57%, having 37+ billion TPV at the end of Q2 of 2020.

It is for US users only, so you can check similar projects in your country to analyze market opportunities.

Insurance

Not surprisingly, fintech has influenced this sector too, successfully introducing the Insurtech term to the world. Tech-driven insurance companies take advantage of innovations to provide various services: getting insurance details can be as easy as clicking a button on the phone screen while managing coverage can be easily accomplished via a convenient user-friendly application. Insurtech trends include artificial intelligence, predictive analytics, implementation of chatbots, and even drones to collect and analyze data to make a compensation decision. In many markets, insurers have also begun using telematics to evolve the core auto product. These scenarios aren’t science fiction as such innovative instruments could become mainstream in the next few years.

Crowdfunding Platforms

History has lots of records of fundraising through the crowd: services like Kickstarter or Patreon have been giving small startups or even individuals an opportunity to receive basic or additional funding for their projects. As there is no need to go to a bank and ask for a loan anymore, such platforms have been gaining popularity and there is still room for newbies on the market. The crowdfunding market is expected to witness a growth at a CAGR of over 16% during the forecast period 2021-2026.

Companies in the equity financing sector also let businesses raise money easily. For instance, some of them are connecting accredited investors with startups while others are using crowdfunding models.

International Money Transfers

Just a decade ago the speed of international money transfers was really an issue. Besides that, the commission was pretty high (approx. 8%) so both clients and banks were looking for faster ways of sending money. Fintech companies today offer faster and less expensive international money transfers.

For instance, the Ripple company has been able to reduce the time for a transaction from hours to just a few seconds.

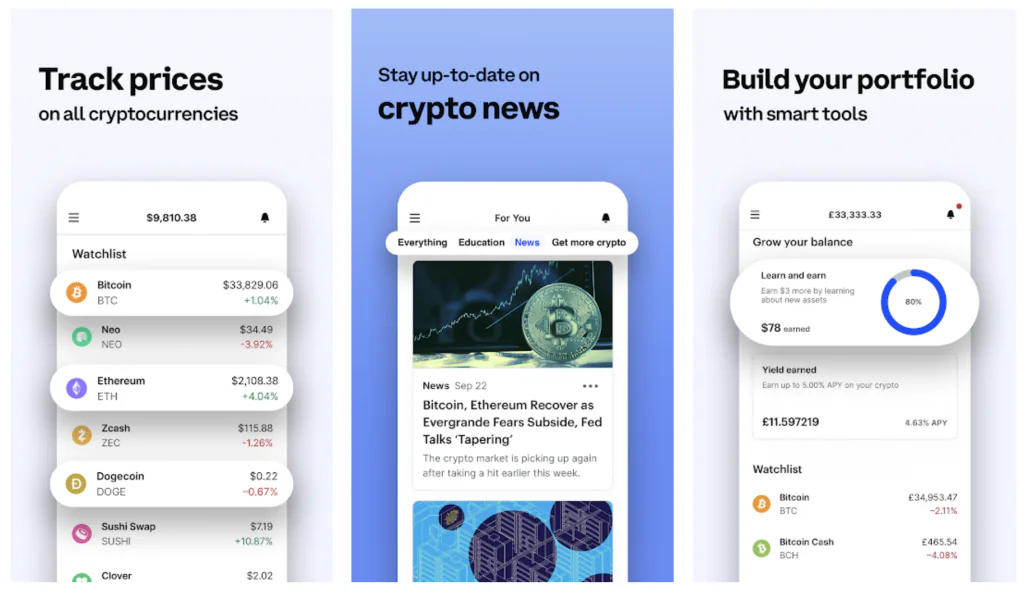

Blockchain and Cryptocurrency

Cryptocurrency exchanges are becoming an increasingly popular type of fintech business to invest in: it is a simple and convenient way to buy and sell preferred cryptocurrencies. If you are considering investing in such a project, a good example to look up to is Coinbase, a popular platform that connects users through its website and an app. Now it has over 68 million users across 100+ countries. The service markets itself as a safe way to purchase, store, trade, and sell crypto (bitcoin, dogecoin, litecoin, ethereum etc.). Here, users (both beginners and experts) have the ability to build a portfolio, keep up with the latest crypto news and navigate the market easily.

One more example is Gemini, a simple and secure crypto-native finance platform to build a crypto portfolio. It is a New York trust company regulated by the New York State Department of Financial Services. As mentioned on their website, Gemini was founded with a “security-first” mentality.

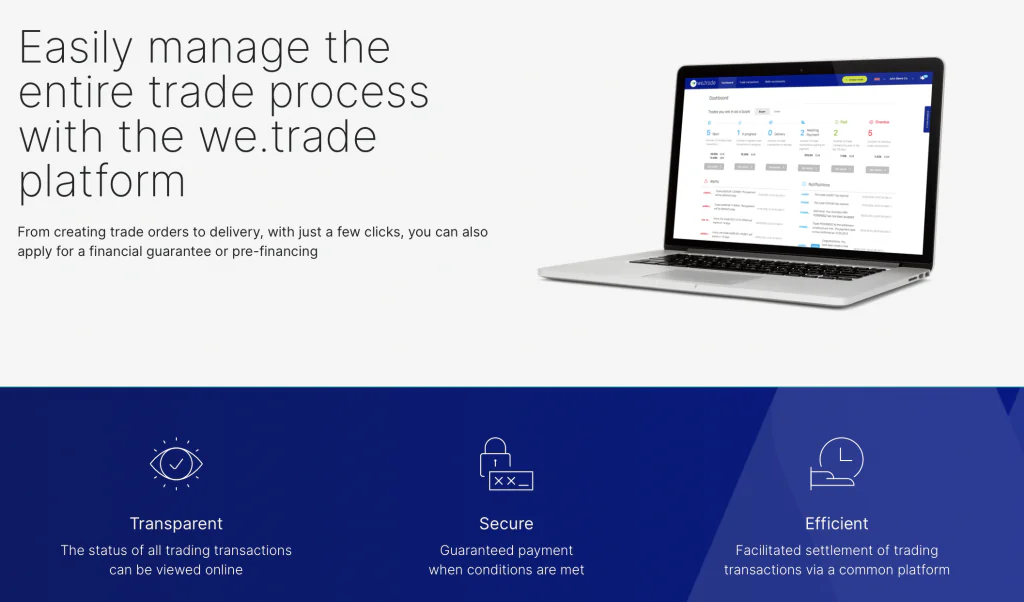

Another hyped term in the fintech sector is Blockchain as it plays a major role in financial innovations. By storing data across its network, blockchain eliminates the risks of data counterfeiting, which is especially important in the banking sector. There are 80 million blockchain wallet holders globally and their number is increasing; it proves that blockchain’s influence in democratizing finance is already tangible.

Speaking about the most active and successful blockchain projects in the financial sector, we.trade is totally worth mentioning. It is an enterprise-grade blockchain-enabled trade finance platform, developed by IBM alongside major banks including CaixaBank, Deutsche Bank, Erste Group, UniCredit.

Lending

Fintech has simplified the way people borrow money. With modern lending products on the market, it is easy to get a loan anytime. It takes seconds to give you the result as advanced software analyzes borrowers’ creditworthiness automatically. Such apps greatly improve client experience and save time. There is no need to attend an office so the queue problem is eliminated. Also, more clients can be served simultaneously.

Credit Karma is a popular personal finance company with over 110 million users in the United States, which is known for pioneering free credit scores. The app has also got useful (and free!) tools for credit and identity monitoring, useful credit card recommendations, shopping for loans, etc.

Consumer Banking

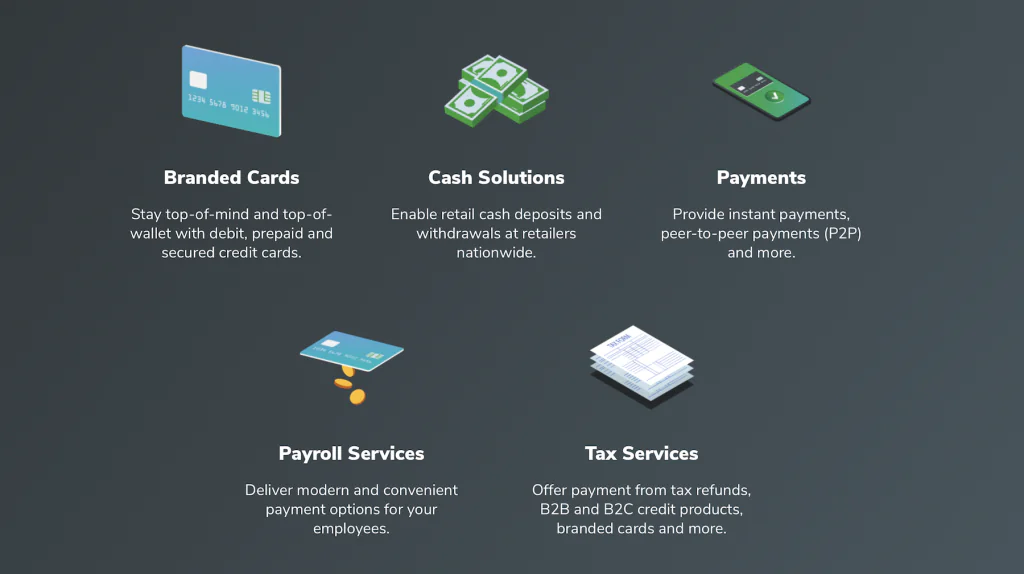

In the past, banks have been the main source of financial services. Now, fintech companies are changing that by providing clients with new options i.e. no fee debit cards or credit card approval in less time. Green Dot platform provides an integrated bank, program management, and enterprise-grade APIs. It is focused on making modern banking and money movement accessible for everyone by providing convenient financial technology services and payment solutions (now for 33 million customers!).

Robo-Advising and Stock-Trading

Robo-advisors are definitely influencing the asset management industry by giving smart recommendations that decrease costs for clients. Implementing such a solution is more effective than hiring an expert with limited working hours, as the system can analyze data 24/7 with no need for time breaks.

Stock-trading apps are also gaining a lot of attention recently. Before their development investors basically had to go to a stock exchange, but now they can perform all the operations via their smartphone from any location. There are lots of directions for startups to choose from:

- Machine Learning and Artificial Intelligence help traders to effectively capture and analyze tons of data to make accurate decisions;

- money transfer services help to transfer money from stocks and asset trading directly into the trader’s bank accounts;

- blockchain solutions provide a secure way of conducting international transactions.

Budgeting Apps

The traditional way of getting finance advice was through banks and involved a lot of human interaction, but now people are able to receive personalized budgeting tips right from their smartphones. Apps like Mint or FinancialAdvisor have replaced inconvenient Excel Sheets and notebooks as they can give you all kinds of resources for managing your money, calculating your monthly payments, and saving smarter.

Ideas for B2B fintech products

Starting a fintech project, make sure you have defined its target audience accordingly. Besides individual users, companies can serve financial institutions and their partners, big corporations, or even the government (B2G). If you consider entering a B2B market, there are a lot of opportunities for newbies.

- businesses can utilize cloud-based instruments and CRMs. Successful example: Salesforce

- small businesses can get fast and easy loans via AI-based platforms. Successful example: Kabbage

- businesses can implement smart payment cards for employees to buy things they need for work. Successful fintech startup example: Pleo

- companies can manage cross-border revenue and financing in their business. Successful fintech startup example: Airwallex

- companies can implement corporate credit cards. Successful fintech startup example: Brex

Conclusion

Fintech is the future of finance: it has drastically changed the global financial sector and now it is playing a significant role in improving the way investors actually participate in stock markets. Companies have been designing various innovative products including budgeting applications, payment platforms, e-wallets, or other tools to help manage consumers’ money effectively.

It’s clear that the most talked-about fintech industry startups share one thing in common: they are born to challenge traditional providers. These newcomers come with more nimble technology, providing faster services than any old institution can offer.

However, banks and related institutions are not going to be left behind in this game of innovation, as they begin investing in modern solutions to meet their clients’ expectations. And it’s not enough just to keep up with innovations and tech trends: to compete against startups effectively, traditional institutions require major changes in many corporate aspects: starting from company structure to employees’ acquaintance with implemented technologies and further training. Eventually, more fintech app ideas for startups would be born which would open even more opportunities for newcomers around the world.

If you are wondering how to build a fintech startup and what are the current trends in financial technology, check out other related articles in our blog. If your project requires fintech app development services, please contact us so we could help your company grow!